- Home

- OFweek News

- Brazil's EV Boom: How Chinese Automakers Are Reshaping South America's Largest Car Market

Brazil's EV Boom: How Chinese Automakers Are Reshaping South America's Largest Car Market

Published: February 20, 2025 14:55

This article is republished with permission from 禾颜阅车(heyanyueche).

Brazil's automotive sector is experiencing remarkable growth, emerging as a coveted prize for global automakers. New vehicle registrations jumped 14.1% in 2024 to 2.63 million units—the highest level in recent years—according to the Brazilian National Association of Automobile Manufacturers.

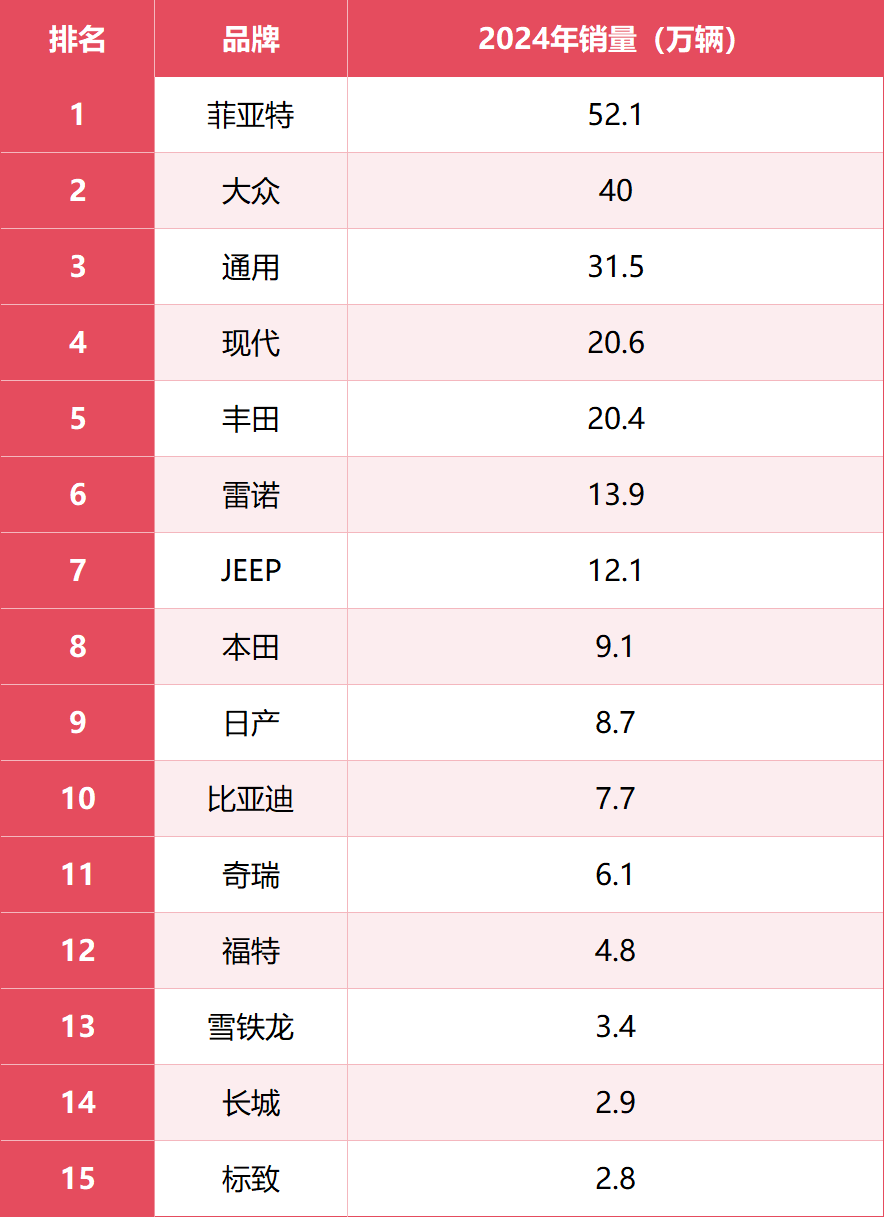

Domestic production reached 2.17 million vehicles (up 10.8%), while imports surged 32.5% to 466,505 units. Stellantis Group, leveraging its Fiat and Jeep brands, dominates with 21.1% market share, followed by Volkswagen (17.2%) and General Motors (13.3%).

source: 禾颜阅车

Compact Cars Rule the Brazilian Roads

The sales charts reveal clear Brazilian preferences, with the Volkswagen Polo leading passenger vehicle sales (140,200 units), followed by the Chevrolet Onix (97,500) and Hyundai HB20 (97,100). This lineup highlights Brazilians' strong affinity for compact vehicles.

source: 禾颜阅车

In the light commercial segment, the Fiat Strada pickup reigns supreme with 144,700 units sold. Much like the multi-purpose minivans once popular in emerging markets, these versatile pickups that handle both daily commuting and light cargo duties have carved out a significant niche in Brazilian consumer culture.

source: 禾颜阅车

Brazil's EV Revolution: Driven by Smart Policy

While Brazil's automotive landscape remains dominated by flex-fuel vehicles (79.1% market share, growing 8.7% to 1.97 million units), the EV sector is experiencing explosive growth. Pure electric vehicles surged 219.2% to 61,535 units, capturing 2.5% of the market. Hybrids also showed strong momentum, growing 32.5% to 56,193 units.

This remarkable EV acceleration stems directly from Brazil's forward-thinking policies. The government's Rota2030 initiative, launched in 2018, aims for EVs to represent 30% of all vehicle sales by 2030, backed by 19 billion reais in tax incentives through 2028.

source: 禾颜阅车

The game-changer, however, was Brazil's 2015 decision to eliminate the 35% import tariff on electric vehicles while offering up to 7% tariff reductions for hybrids. This strategic move created a perfect entry point for Chinese manufacturers like BYD and Great Wall, allowing them to introduce competitive EVs without the traditional barriers to entry. Established Western automakers, caught flat-footed with less competitive EV offerings, struggled to mount an effective response.

Brazil's EV push aligns with broader economic interests. Despite importing 290,250 barrels of crude oil daily in 2023, Brazil's vast geography offers tremendous renewable energy potential. A successful transition to electric mobility would significantly reduce the nation's dependence on imported petroleum, creating both economic and environmental benefits.

source: 禾颜阅车

Chinese Automakers: Making Their Mark

Chinese manufacturers have capitalized brilliantly on Brazil's EV-friendly policies. BYD exemplifies this success, with sales skyrocketing 327.7% to 76,700 vehicles in 2024, securing 3.1% market share. Its Latin American Dolphin model has become Brazil's top-selling electric vehicle, while the company's electric buses have also gained significant traction. BYD's factory in Bahia state, expandable to 300,000-unit capacity, is positioned to become a strategic hub for the entire South American market.

source: 禾颜阅车

Chery, focusing on compact SUVs, has partnered with Latin American automotive giant CAOA to nearly double its sales to 60,900 units (up 93.6%). As one of the first Chinese manufacturers to establish Brazilian operations—exporting Tiggo models there since 2009—Chery now faces the critical challenge of transitioning its predominantly combustion-engine lineup toward electrification.

source: 禾颜阅车

Great Wall Motor sold 30,000 units last year, penetrating the premium segment with its hybrid Haval H6 and all-electric Ora 03. The company's Iracemápolis factory, slated to begin production in 2025, promises to strengthen Great Wall's position in the market.

The wild card may be Leapmotor, which enjoys a strategic advantage through Stellantis' substantial ownership stake. This relationship potentially offers Leapmotor turnkey access to Stellantis' established manufacturing facilities and dealer networks throughout Brazil. If leveraged effectively, this partnership could accelerate Leapmotor's affordable EV models throughout Latin America.

source:禾颜阅车

The Road Ahead: Intensifying Competition

Despite their impressive gains, Chinese automakers face mounting challenges. Brazil's zero-tariff EV policy is being phased out, with the full 35% import duty returning by 2026. This shift necessitates a pivot from exports to local manufacturing—a transition complicated by cultural and labor differences, as evidenced by BYD's recent workforce challenges.

source:禾颜阅车

Meanwhile, Japanese automakers are mounting a counteroffensive. Toyota plans to invest 11 billion reais in São Paulo state operations, focusing on flex-fuel compact vehicles. Honda is similarly expanding its Brazilian footprint, planning to hire 1,700 additional workers to produce flex-fuel SUVs—a clear sign of its commitment to the market.

source:禾颜阅车

Perhaps most formidable is the inevitable response from entrenched players like Stellantis. With deep roots in Latin America through its Fiat and Jeep brands, Stellantis possesses the market understanding, distribution networks, and consumer loyalty to defend its territory aggressively. Whether Great Wall's pickups can successfully challenge the beloved Fiat Strada remains an open question.

source:禾颜阅车

Strategic Implications

Brazil represents not just South America's largest automotive market but a strategic gateway to the continent. For Chinese manufacturers, establishing a strong Brazilian presence creates a platform for regional expansion. However, unlike some markets where Chinese brands faced limited competition, Brazil presents a complex competitive landscape featuring America's automotive giants, European conglomerates with decades of local experience, and Japanese manufacturers with established regional followings.

The coming years will reveal whether Chinese automakers can translate their initial EV advantage into sustainable market positions as the playing field gradually levels through policy adjustments and competitive responses.