- Home

- OFweek News

- Multiple Robot Companies Release Earnings Forecasts! Profits Surge by Over 30 Times

Multiple Robot Companies Release Earnings Forecasts! Profits Surge by Over 30 Times

Published: February 14, 2025 17:30

In the ever-evolving global economic landscape and increasingly intense technological competition, the robotics industry has seen a major annual performance disclosure. Some companies have seized market opportunities to achieve remarkable results, while others face challenges and are striving for breakthroughs.

Everwin Precision

Everwin Precision’s performance in 2024 has been impressive. According to its earnings forecast, the company expects net profit attributable to shareholders to range between 700 million to 820 million yuan, representing a year-on-year growth of 716.78% to 856.79%. The net profit after excluding non-recurring items is projected to be 460 million to 580 million yuan, a significant increase of 2368.86% to 3012.91%. This growth is primarily driven by the recovery in the consumer electronics and new energy markets, which has significantly boosted the company’s revenues.

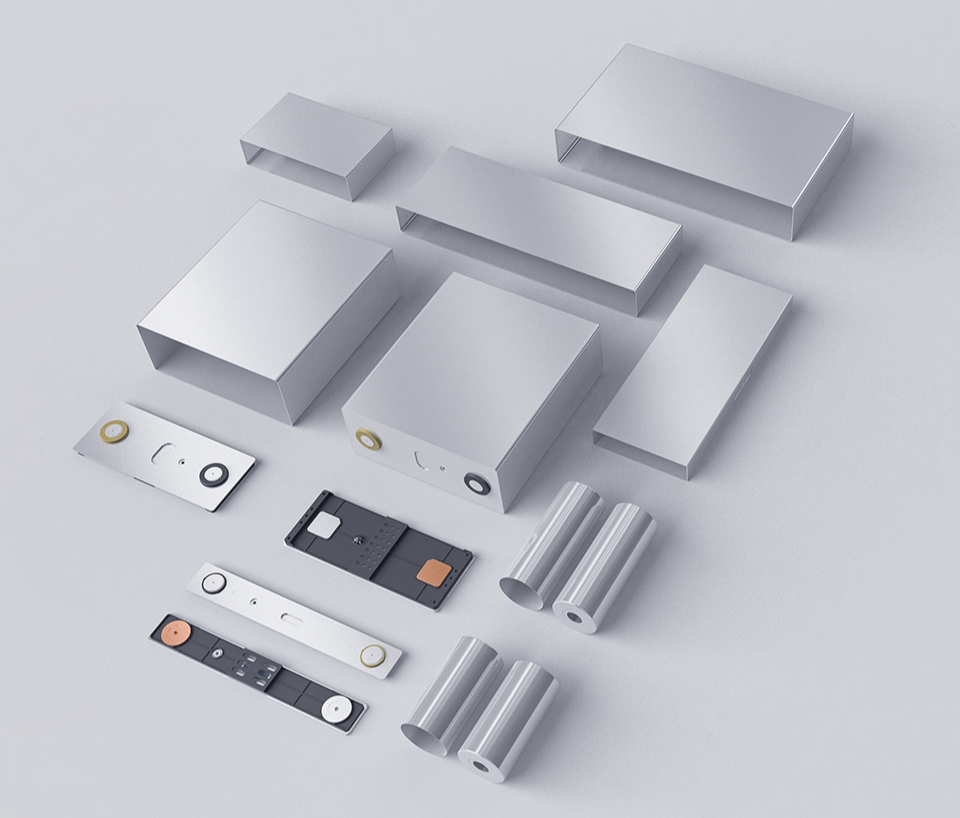

In the first three quarters of 2024, Everwin Precision achieved a revenue of 12.097 billion yuan, an increase of 23.56%, with net profit reaching 594 million yuan, skyrocketing by 38159.10%. Both revenue and net profit hit historical highs, demonstrating strong growth momentum. As a key supplier of precision components, the company also established a wholly-owned subsidiary, Shenzhen Everwin Robot Co., Ltd., to expand its presence in the robotics industry and further solidify its market position.

In the robotics field, Everwin Precision focuses on the development and production of high-precision components, particularly in crucial parts such as joint gears, bearings, and joint sensors. With its outstanding technology and product quality, the company has successfully established close collaborations with leading humanoid robot companies in North America and China, expanding its customer base and receiving a steady flow of orders. Additionally, Everwin Precision’s technological strength has earned it a spot in the core supply chains of top humanoid robot companies like Tesla and Figure AI, opening up substantial growth prospects for the company in the future.

Estun

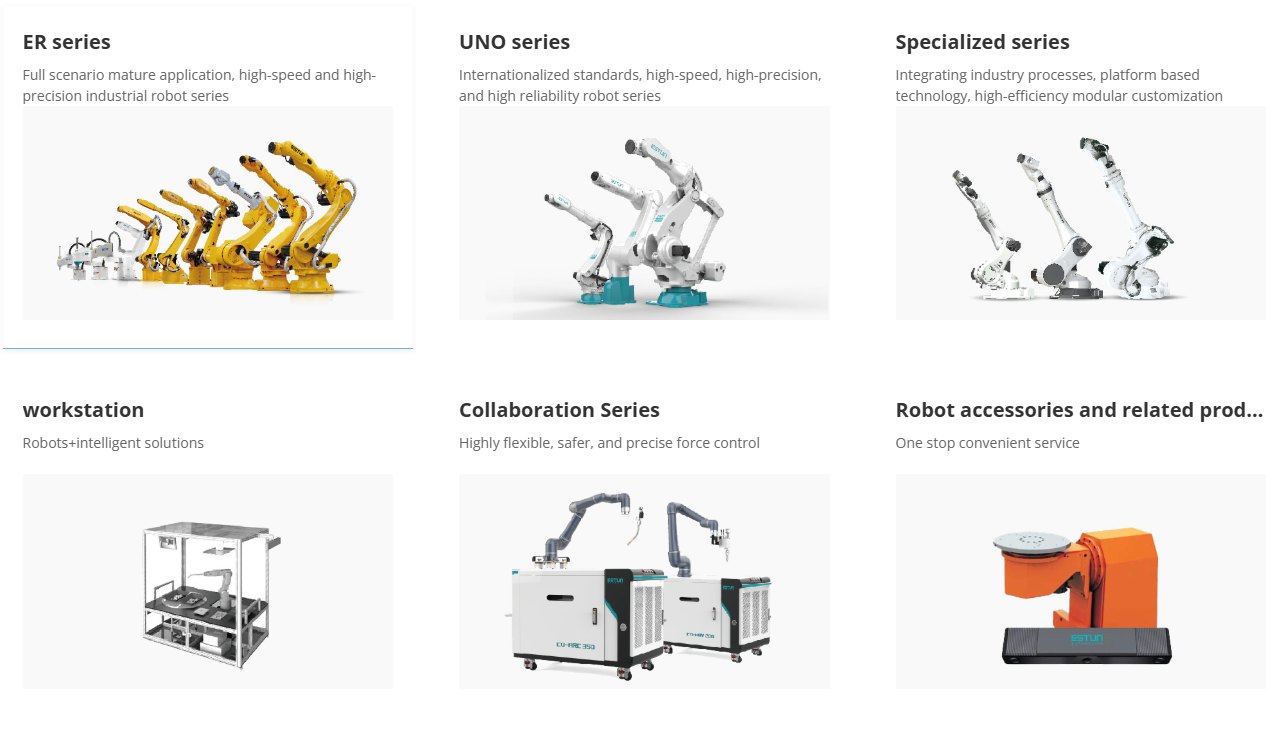

Unlike Everwin Precision, Estun faces significant challenges in 2024. According to its earnings forecast, the company expects a net loss attributable to shareholders between 650 million and 760 million yuan, a decline of 581.33% to 662.79% compared to last year’s profit of 135 million yuan. The net profit after excluding non-recurring items is expected to be a loss of 630 million to 740 million yuan, down 841.14% to 970.54% from last year's profit of 85 million yuan.

Estun attributes its performance decline to market fluctuations. Specifically, the industrial robots and intelligent manufacturing systems segment experienced a significant revenue drop compared to last year. In addition, Estun’s subsidiary, KUKA Germany, suffered from weak downstream demand and a sluggish European market, leading to a sharp decline in revenue. Moreover, Estun’s subsidiaries Yangzhou Shuguang and Shanghai Plexus also faced dual impacts from intensified competition and market changes, resulting in both revenue and profit declines. Overall, operating profits decreased by over 100 million yuan compared to last year.

Despite these losses, Estun continues to show strong market resilience. In the third quarter of 2024, Estun achieved revenue of 1.198 billion yuan, a 21.66% increase, with its industrial robots and intelligent manufacturing systems segment seeing a 19.33% year-on-year growth. This highlights the company’s market competitiveness. According to authoritative data, Estun’s industrial robot shipment growth outpaced the industry average. The company ranked second in the Chinese industrial robot market and first among domestic brands, demonstrating its strong position in the industry.

Additionally, Estun is actively expanding its footprint through its equity stake in Estun Kuzo, which focuses on the robot control systems field. Estun Kuzo integrates AI, cloud-edge technologies, and robotics control systems, providing robotic systems and core components for industries like industrial, medical, and service sectors. The company has attracted new investors to enhance its market competitiveness and improve its technological capabilities.

Orbbec

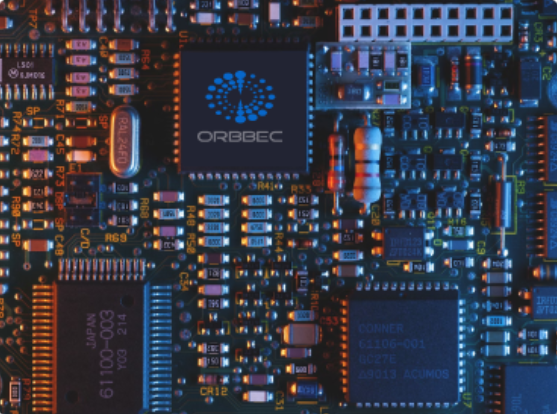

Orbbec has also delivered strong performance in 2024. The company expects revenue of approximately 560 million yuan, a 55.55% year-on-year increase. However, the net profit attributable to shareholders is expected to still be a loss of around 60 million yuan, a significant reduction from last year’s loss of 216 million yuan, with a year-on-year decrease in loss of 78.25%. The net profit after excluding non-recurring items is expected to be a loss of 116 million yuan, which represents a 64.19% reduction in loss compared to last year.

As a leader in China’s robot vision sensor field, Orbbec has been vigorously developing its robotics business, focusing on the integration of robotics and AI vision. In the first three quarters of 2024, Orbbec’s revenue reached 351 million yuan, an increase of 35.27%, while its net loss was 60.3 million yuan, representing a 68.58% reduction in loss compared to last year, reflecting continuous improvement in business performance.

Orbbec’s 3D visual perception technology is a core technology in robotics intelligence. It allows robots to accurately recognize the environment and analyze information, greatly enhancing the robot’s autonomy and adaptability. As demand for 3D visual perception technology grows, Orbbec has gradually expanded its applications in industries such as industrial manufacturing, logistics warehousing, and medical services, boosting productivity and optimizing workflows.

With its strong foundation in robot vision technology, Orbbec holds an important position in the market. As the level of robot intelligence continues to rise, Orbbec’s advantage in this field will become even more pronounced, providing the company with broader development opportunities.

Industry Outlook

In 2024, the performance of companies in the robotics industry varies significantly. Everwin Precision has made impressive strides, benefiting from the recovery in the consumer electronics and new energy markets, and is aggressively expanding in the robotics sector, promising great future potential. Estun, though facing financial difficulties, continues to demonstrate resilience with its solid technology foundation and market position, working on innovations and capital operations to regain momentum. Meanwhile, Orbbec has leveraged its leading 3D visual perception technology to increase its market share in robotics, with its performance steadily improving.

With the arrival of 2025, competition in the industry will only intensify. Innovation, market demand, and capital investment will be key drivers of the industry’s development. For these robotics companies, how they respond to challenges and seize opportunities will play a crucial role in shaping their future. Industry leaders may further consolidate their market positions, while newcomers may find opportunities to rise.

As the competition landscape continues to evolve in 2025, will strong players continue to dominate, or will challengers catch up? We will wait and see.