- Home

- OFweek News

- Cash Crisis at Evergrande Auto: Chinese EV Maker's $500M Rescue Plan Crumbles Amid Market Headwinds

Cash Crisis at Evergrande Auto: Chinese EV Maker's $500M Rescue Plan Crumbles Amid Market Headwinds

Published: February 13, 2025 14:13

In a significant development that has caught market attention, China Evergrande New Energy Vehicle Group (Evergrande Auto) (恒大汽车) announced on February 3rd that it has failed to secure strategic investors or buyers crucial for alleviating its liquidity crisis and advancing group restructuring. The company also highlighted the increasingly challenging operating environment in mainland China's NEV market.

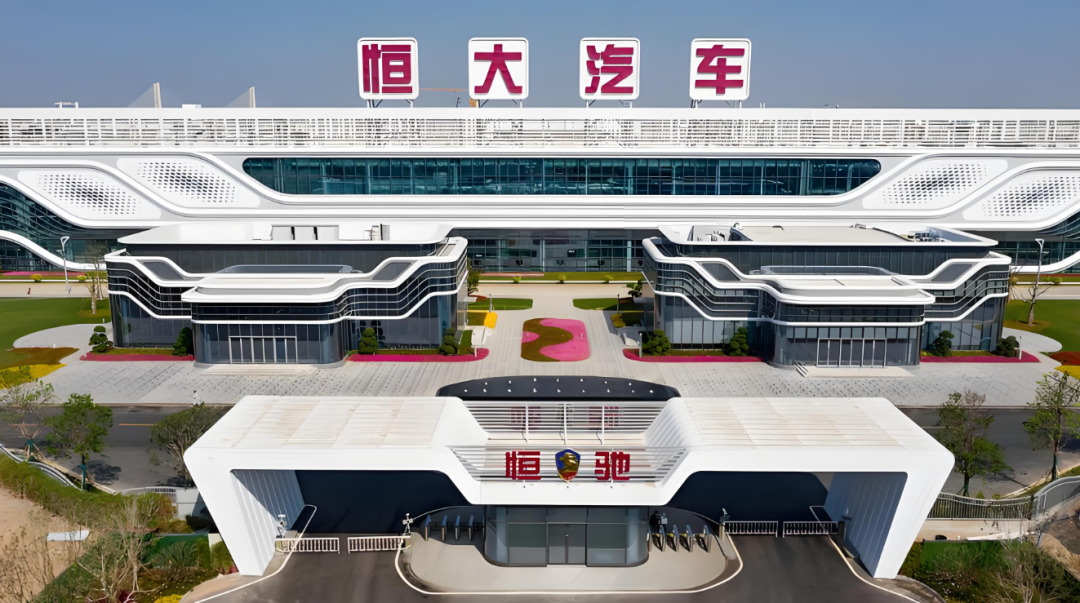

source: Evergrande New Energy Auto

Dual Pressures: Financial Constraints and Market Headwinds

Despite implementing aggressive cost-cutting measures over the past six months, including substantial workforce reductions and operational expense cuts, Evergrande Auto reports critically low cash and cash equivalents - barely sufficient for basic operations. More concerning is the company's inability to ensure essential services, including year-end auditing for 2024, due to financial constraints.

The company emphasized that the current harsh business environment in China's NEV market has significantly hampered efforts to attract strategic investors or buyers. This challenging landscape, characterized by intense competition and industry uncertainties, has likely contributed to potential investors' cautious stance toward Evergrande Auto's future prospects.

A History of Failed Restructuring Attempts

Evergrande Auto's efforts to secure financial stability through strategic investments or share sales have faced repeated setbacks:

The company's current market position reflects these challenges:

• Stock price: HKD 0.20 per share (as of February 6)

• Market capitalization: Approximately HKD 2.2 billion

• Continued active search for strategic investors or buyers despite market headwinds

Key Challenges Ahead:

1. Severe liquidity constraints

2. Difficulty in attracting strategic investors

3. Harsh market conditions in China's NEV sector

4. Operational sustainability concerns

Market Position and Future Outlook

The company's future trajectory will largely depend on its ability to secure suitable partnerships in this complex market environment while effectively improving its operational fundamentals.