- Home

- OFweek News

- Energy Storage Unicorn's 281% IPO Surge: Inside Hyperstrong's $1.6B STAR Market Debut and China's Energy Storage Revolution

Energy Storage Unicorn's 281% IPO Surge: Inside Hyperstrong's $1.6B STAR Market Debut and China's Energy Storage Revolution

Published: February 13, 2025 10:30

The stock, priced at ¥19.38 per share at IPO, opened with a remarkable 281% increase, reaching a high of ¥73.95. During pre-market trading, it briefly touched ¥84, representing a 335% gain. At the time of reporting, the stock traded at ¥64.9, bringing the company's market capitalization to approximately ¥11.5 billion.

The path to listing spanned over 600 days, during which Hyperstrong underwent two rounds of regulatory scrutiny from the exchange. According to the prospectus, Hyperstrong has dedicated over a decade to energy storage systems, witnessing the industry's evolution from pilot demonstrations to large-scale commercialization. The company has successfully commercialized its technology across shared energy storage stations, solar plants, and wind farms, establishing a prominent market position.

According to Hyperstrong, in 2024, it has been ranked in the BloombergNEF Energy Storage Tier 1 list for three consecutive quarters. According to S&P Global Commodity Insights, HyperStrong has been ranked among the top three BESS integrators in terms of global capacity installed in 2023. The China Energy Storage Alliance (CNESA) rankings show Hyperstrong leading the domestic energy storage systems market from 2021-2022, before taking second place in 2023 (noting that Sungrow(阳光电源)occasionally abstained from domestic rankings).

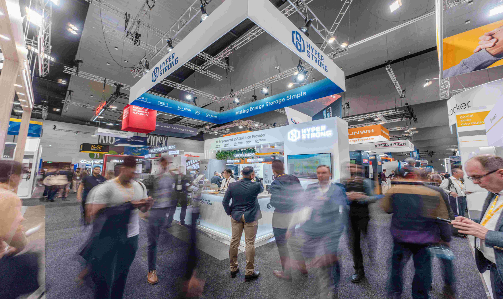

source: Hyperstrong

Financial analysis reveals impressive growth in Hyperstrong's core business. Energy storage system revenues grew from ¥653 million in 2021 to ¥2.46 billion in 2022, reaching ¥6.93 billion in 2023 - a compound annual growth rate of 225.62%. This segment now represents 99.3% of total revenue, up from 78.52%.

While Hyperstrong has cultivated strong relationships with major clients, this has led to customer concentration risks. The top five customers accounted for 78.16%, 83.70%, and 74.37% of sales from 2021-2023 respectively, attracting regulatory attention. However, this concentration largely reflects the nature of China's utility-scale storage market, dominated by major power companies.

A significant challenge for Hyperstrong has been its limited international presence. As of 2023, the company reported no direct overseas revenue, in contrast to domestic competitors like Sungrow Power and Pylon Technologies(派能科技), which have established global operations years ago.

However, being 2-3 years ahead in domestic technology development means it's not too late for international expansion. Since 2023, Hyperstrong has simultaneously launched market development initiatives across North America, Europe, and Australia, achieving initial breakthrough orders. By the end of March 2024, Hyperstrong's international order book reached approximately 323.55MW, with contract values exceeding $60 million.

source: Hyperstrong

IPO Insights: Market Timing and Strategic Positioning

In a highly competitive sector, both the rise and decline of enterprises follow discernible patterns. Hyperstrong's successful A-share listing reflects both excellent timing with China's energy transition and alignment with the country's global development strategy.Founded in 2011, Hyperstrong demonstrated early market foresight by completing demonstration projects for State Grid's microgrid storage and Southern Grid's distributed modular storage systems in 2012-2013, when energy storage was still in its infancy.

The company's breakthrough came in 2018 with multiple substation storage project wins from both State Grid and Southern Grid. The business saw explosive growth from 2020 onward, driven by China's dual carbon policy initiatives focusing on power generation.

Financial performance has been impressive, with revenues of ¥838 million, ¥2.63 billion, and ¥6.98 billion from 2021-2023, plus ¥3.69 billion in H1 2024. Net profits attributable to shareholders grew from ¥11.26 million to ¥177 million, ¥578 million, and ¥282 million in the same periods.

While Hyperstrong benefited from perfect market timing, success required more than just timing. The company's alignment with China's "New Nine Guidelines" for STAR Market listings proved crucial. These guidelines require companies to not only serve national strategic interests with core technologies and innovation capabilities but also demonstrate stable business models, market recognition, and strong growth potential.

The energy storage integration sector has often been misunderstood as a low-barrier industry where anyone with basic components and engineering staff could compete. However, the lack of unified standards means that accumulated experience and know-how become critical differentiators. System integration expertise must be proven through practical implementation, with vendor capabilities reflected in system details.

In its prospectus, Hyperstrong emphasizes that system integration encompasses multiple technical domains including battery technology, power electronics, large-scale integrated circuits, embedded systems, algorithms, mechanical and thermal engineering, AI, and big data.

Key competencies include:

- Accurate power demand analysis for optimal system design

- Component selection and matching for system optimization

- Real-time battery parameter monitoring using power electronics and integrated circuits

- Battery balancing for enhanced performance and longevity

- Comprehensive BMS protection features

- Advanced control strategies for charging, discharging, and power regulation

- Seamless integration with power grids and distributed energy resources

- AI and big data analytics for predictive maintenance and reliability optimization

This comprehensive approach demonstrates why successful energy storage integration requires far more sophistication than simple component assembly.

source: Hyperstrong